Paycheck QuickBooks is a vital feature for small business owners, bookkeepers, and accountants who rely on QuickBooks to run smooth and accurate payroll. Whether you’re issuing your first paycheck or handling ongoing employee payments, QuickBooks simplifies the process by automating calculations, tax deductions, and pay stub creation. This guide will walk you through everything you need to know—from setting up payroll to generating and printing paychecks—securely and efficiently.

What Does “Paycheck” Mean in QuickBooks?

In QuickBooks, a paycheck is the result of a payroll run—automatically calculating wages, tax deductions, and net pay for each employee. Whether you’re using QuickBooks Online Payroll or QuickBooks Desktop Payroll, the system streamlines the full cycle of payroll processing.

Key Functions of Paycheck Management in QuickBooks:

- Calculates gross and net pay based on settings

- Deducts federal, state, and local taxes automatically

- Offers both direct deposit and printable checks

- Allows secure employee paystub access

- Integrates with time tracking and benefits

How to Run Payroll and Generate Paychecks in QuickBooks Online

Creating a paycheck in QuickBooks Online is fast, simple, and efficient. Here’s how:

Step 1: Activate Payroll Features

To begin:

- Go to Payroll > Overview

- Add your EIN, bank details, and employee profiles

- Set pay frequencies and benefits, if applicable

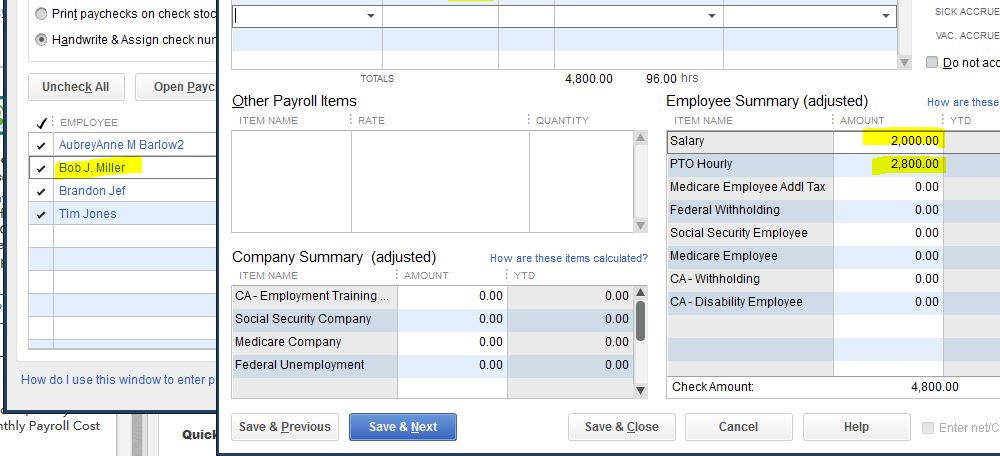

Step 2: Process Payroll

1- Navigate to Payroll > Employees

2- Select Run Payroll

3- Choose the correct pay period and pay date

4- Enter work hours, overtime, or bonuses

5- Click Preview Payroll to confirm totals

6- Finalize by clicking Submit Payroll

Step 3: Select Paycheck Delivery Option

- Direct Deposit: Sent directly to employee bank accounts

- Paper Checks: Printable within QuickBooks for manual delivery

Pro Tip: Use direct deposit to eliminate check printing costs and reduce payroll errors.

How to Modify or Cancel Paychecks in QuickBooks

Need to make changes to a paycheck? QuickBooks allows you to void or revise paychecks within set timeframes.

Voiding a Paycheck:

1- Go to Payroll > Paycheck List

2- Find the paycheck and click Void

3- Confirm to remove it from payroll records

Editing a Paycheck:

If the payroll hasn’t been submitted, you can:

- Click Edit next to the paycheck

- Adjust hours, deductions, or compensation

Caution: If the paycheck has already been sent or taxes have been filed, voiding may be required before reissuing.

How to Manage Paychecks on the QuickBooks Mobile App

QuickBooks Online’s mobile app enables flexible payroll on the go. Perfect for small business owners or HR managers on the move.

Mobile Features Include:

- Running payroll from your smartphone

- Reviewing past paychecks and stubs

- Using biometric login for secure access

- Approving employee hours before processing pay

Available for both Android and iOS devices via the respective app stores.

How Employees Access Paychecks in QuickBooks Workforce

QuickBooks provides a self-service portal for employees via Workforce.

Employee Access Instructions:

- Visit workforce.intuit.com

- Sign in using their registered email

- Download paystubs and view W-2s anytime

This tool reduces HR support workload while giving employees real-time payroll access.

Troubleshooting QuickBooks Paycheck Issues

Occasionally, you may run into hiccups when processing payroll. Here are some common issues and how to resolve them:

1. Paycheck Doesn’t Appear

- Verify that the employee is active

- Check if the correct pay schedule is applied

2. Incorrect Withholding Amounts

- Review employee tax setup and filing status

- Update any recent local or state tax changes

3. Direct Deposit Failures

- Recheck bank routing and account numbers

- Ensure the deposit date is valid and not on a weekend or holiday

4. Duplicate or Missed Paychecks

- Use the Payroll History Report to check for duplicates

- Void and reprocess if needed

Best Practices for Payroll and Paycheck Security

Security and compliance are critical when dealing with employee pay. Follow these tips to ensure data integrity:

- Use unique, strong passwords for QuickBooks access

- Enable two-factor authentication (2FA) to block unauthorized logins

- Avoid public Wi-Fi when processing payroll

- Always log out after finishing payroll tasks on shared devices

Pro Tip: Schedule payroll reminders to ensure no paycheck runs are missed due to holidays or business closures.

Paycheck QuickBooks for Accountants

If you’re a CPA or bookkeeper managing payroll for multiple clients, use QuickBooks Online Accountant (QBOA):

How to Access Client Payroll:

- Visit quickbooks.intuit.com/accountants

- Log in using your Intuit Accountant ID

- Select the client company and run payroll from the dashboard

Accountants can manage multiple payroll clients under a single login, streamlining the payroll process across businesses.

Frequently Asked Questions

Q: Can I reprint a paycheck or paystub in QuickBooks?

Yes, go to Payroll > Paycheck List, open the paycheck, and select Print Paycheck or Print Pay Stub.

Q: How do I run off-cycle paychecks (bonuses or missed hours)?

From the Payroll tab, select Run Payroll and choose a custom pay date to issue one-time or bonus payments.

Q: Is QuickBooks Payroll compliant with tax regulations?

Yes, QuickBooks handles federal, state, and local payroll tax filings, and provides automatic updates to stay compliant.

Final Thoughts: Simplify Payroll with Paycheck QuickBooks

Whether you’re a business owner or an accountant, QuickBooks makes paycheck management faster, safer, and smarter. From automation to secure delivery, this platform gives you the tools you need to confidently handle every aspect of payroll—while reducing errors and saving time.

Start using QuickBooks to its full potential and give your team the reliable paychecks they deserve—on time, every time.

Whether you’re paying hourly employees or salaried staff, Paycheck QuickBooks simplifies the entire process. By mastering its features, you ensure timely payments, reduce payroll errors, and keep your business finances organized. Start using Paycheck QuickBooks today to streamline your payroll operations.