If you’re facing issues with payroll taxes not being deducted in QuickBooks Desktop, you’re not alone. This uncommon, yet concerning issue can cause significant disruptions for businesses that rely on QuickBooks for accurate payroll processing. But why does this happen, and how can you resolve it?

QuickBooks payroll is designed to automatically calculate taxes, but sometimes it fails to deduct them properly. In this article, we’ll break down the most common causes of payroll tax calculation issues and provide actionable steps to fix them, ensuring your payroll runs smoothly.

Table of Contents

- Why Is QuickBooks Payroll Not Taking Out Taxes?

- Low Employee Gross Wages

- Outdated Payroll Tax Tables

- Exceeded Annual Salary Limits

- Incorrect Employee Tax Setup

- Unsubscribed or Expired Payroll Service

- Incorrect Employee Wage and Tax Details

- Payroll Subscription Issues

- Company File Errors

- Tax-Exempt Employee Settings

- How to Fix Payroll Tax Deduction Issues in QuickBooks Desktop

- Check Year-to-Date or Quarter-to-Date Wages

- Resolve Payroll Subscription Problems

- Adjust Annual Limit Settings

- Repair Company File Errors

- Fix Tax-Exempt Settings

- Additional Steps to Resolve Payroll Tax Calculation Errors

- Update Payroll Tax Tables

- Revert Paychecks and Recalculate Taxes

- Verify Employee Tax Setup

- Advanced Troubleshooting for Persistent Payroll Tax Issues

- How to Prevent Payroll Tax Calculation Errors in the Future

- When to Contact a Professional for Help

- FAQs

Why Is QuickBooks Payroll Not Taking Out Taxes?

There are several potential reasons why QuickBooks Desktop might not be deducting payroll taxes. Below are the most common causes:

Low Employee Gross Wages

If an employee’s gross wages are below the threshold for tax calculations, QuickBooks may skip the deduction process. This is especially common for part-time or hourly employees with lower earnings.

Outdated Payroll Tax Tables

QuickBooks relies on updated tax tables to calculate payroll taxes accurately. If your tax tables are outdated, it could prevent proper deductions. Ensure you’ve downloaded the latest updates, especially after tax changes.

Exceeded Annual Salary Limits

When an employee’s earnings surpass a certain annual limit, QuickBooks might stop deducting taxes to comply with federal or state tax regulations.

Incorrect Employee Tax Setup

Errors in the employee profile, such as missing or incorrect tax information (e.g., filing status, exemptions), can lead to tax calculation mistakes. Double-check employee records for accuracy.

Unsubscribed or Expired Payroll Service

If your QuickBooks payroll subscription is inactive or expired, payroll tax calculations may not work as expected. Ensure your subscription is up to date to avoid interruptions.

Incorrect Employee Wage and Tax Details

Misconfigured year-to-date or quarter-to-date wages can disrupt tax deductions. Ensure that your employee’s wage and tax information are accurate and updated.

Payroll Subscription Issues

An inactive or expired payroll subscription will halt tax calculations. Make sure your subscription is current to avoid problems.

Company File Errors

Corrupt or damaged company files can interfere with payroll tax deductions. If your file is damaged, QuickBooks won’t be able to pull payroll data correctly, causing deductions to fail.

Tax-Exempt Employee Settings

If an employee is incorrectly marked as tax-exempt in QuickBooks, taxes won’t be deducted from their paycheck. Verify that employees who should have taxes deducted are not flagged as tax-exempt.

How to Fix Payroll Tax Deduction Issues in QuickBooks Desktop

Once you’ve identified the cause, here’s how to fix the issue:

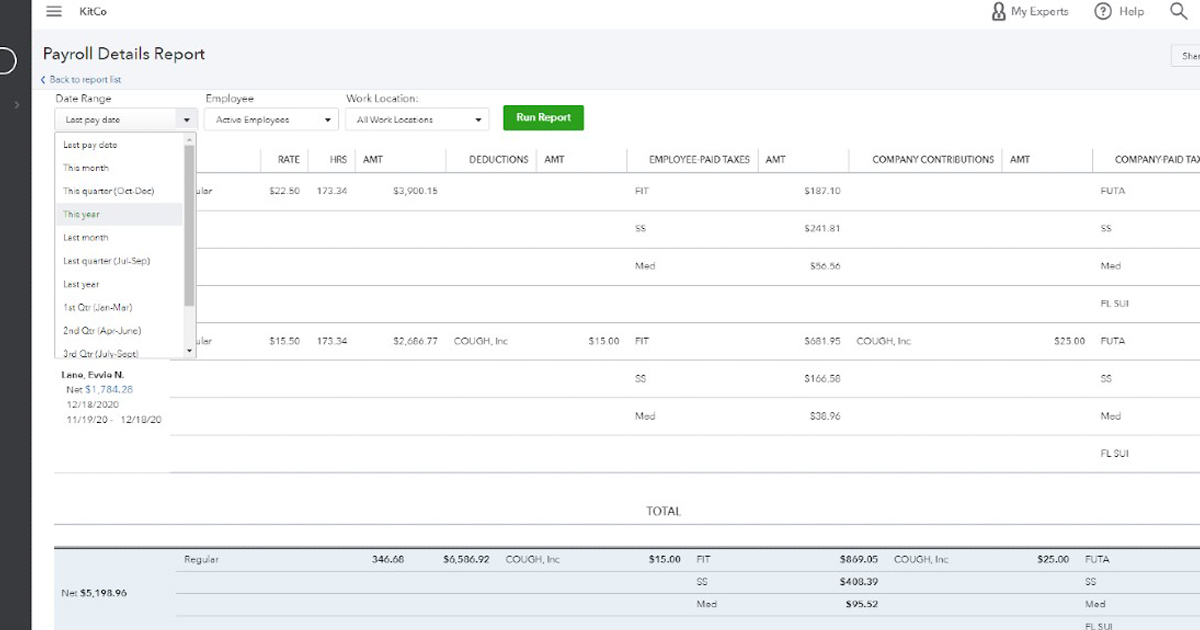

1. Check Year-to-Date or Quarter-to-Date Wages

Ensure employee wage data is accurate:

- Run an Employee Withholding Report to verify the data.

- Review and update employee tax settings to correct any inaccuracies.

2. Resolve Payroll Subscription Problems

If your payroll subscription is expired:

- Verify subscription status by going to Employees > My Payroll Service > Account/Billing Information.

- Renew your subscription if necessary.

3. Adjust Annual Limit Settings

If tax deductions stop due to salary limits:

- Review Payroll Item Settings and correct any errors in the limits.

4. Repair Company File Errors

To repair corrupt files:

- Use the QuickBooks File Doctor tool from the QuickBooks Tool Hub.

- Follow the on-screen instructions to fix company file errors.

5. Fix Tax-Exempt Settings

To adjust tax-exempt settings:

- Go to the Employee Center and edit employee profiles.

- Uncheck the Tax-Exempt box if applicable and re-run payroll.

Additional Steps to Resolve Payroll Tax Calculation Errors

If the above fixes don’t solve the issue, try these additional steps:

Update Payroll Tax Tables

Ensure you have the latest tax tables by going to Employees > Get Payroll Updates in QuickBooks. Download and install the updates to resolve tax calculation issues.

Revert Paychecks and Recalculate Taxes

If you’ve made adjustments to paychecks, you may need to revert them and re-enter payroll data to refresh tax calculations.

Verify Employee Tax Setup

Double-check employee profiles for accuracy, including federal, state, and local tax settings. Correct any discrepancies.

Contact QuickBooks Support

If the problem persists, reach out to QuickBooks customer support for professional assistance.

Advanced Troubleshooting for Persistent Payroll Tax Issues

If the payroll tax issue remains unresolved, try these advanced troubleshooting steps:

Reinstall QuickBooks Desktop

Reinstalling QuickBooks can fix persistent software errors that may be affecting payroll functionality. Use the Clean Install Tool from the QuickBooks Tool Hub for a fresh installation.

Ensure You Have the Latest Version of QuickBooks

Keeping QuickBooks up to date is essential for preventing payroll issues. Check for updates under Help > Update QuickBooks Desktop.

Manually Calculate Payroll Taxes

In extreme cases, manually calculate payroll taxes and enter the correct amounts into QuickBooks, following IRS and state tax guidelines.

How to Prevent Payroll Tax Calculation Errors in the Future

To avoid payroll tax issues, consider these preventive measures:

- Regularly update QuickBooks and tax tables.

- Review employee profiles and payroll items before running payroll.

- Maintain an active payroll subscription.

- Create regular backups to avoid company file corruption.

When to Contact a Professional for Help

If you’ve followed all troubleshooting steps and the issue persists, it’s time to contact a QuickBooks ProAdvisor or customer support. They can help diagnose and resolve complex payroll tax issues.

FAQs

Why are payroll taxes not being deducted in QuickBooks Desktop? Common reasons include outdated tax tables, incorrect employee tax setup, inactive payroll subscription, or company file errors.

How do I fix payroll tax calculation errors in QuickBooks? Update QuickBooks and tax tables, verify employee tax settings, and correct payroll item configurations.

What should I do if my payroll subscription has expired? Renew your subscription through the Employees > My Payroll Service > Account/Billing Information menu.

How can I avoid payroll tax calculation errors in the future? Regularly update QuickBooks, verify employee profiles, and maintain an active payroll subscription.